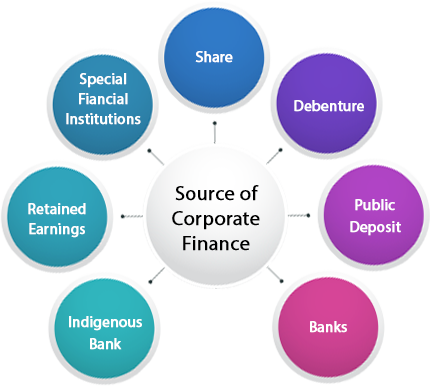

Corporate Finance

The proper capitalization of a company – created through newly-sourced and redeployed capital – can allow for equity risk diversification, improved cash flow and accelerated growth, if desired. A properly designed capital structure will eliminate or lessen personal guarantees and associated risks; improve cash flow through the elimination of high-cost debt, excessive debt-service requirements and/or onerous prepayment penalties; provide capital for and lessen restrictions on capital expenditures and growth; lessen or remove financial and operating covenants and restrictions; and finally, reduce the number of capital providers with a “say” in corporate matters.

The professionals of Alrama Capital have a successful track record of identifying and procuring the appropriate capital type with structure and terms that are consistent with a company’s short and long-term objectives including senior debt; sale-leaseback financing; subordinated/mezzanine debt and equity.

Whether you are a new start-up that needs funding or an existing business that is looking to grow, with corporate finance services from Alrama Capital you will be in good hands. The whole process will be managed by us from start to finish. This leaves you with more time to concentrate on setting up and running your business.